Stanbic bank fires 10 staff to win clients’ confidence

Stanbic Bank may undeniably be one of the leading banks in Uganda. The alleged $1.8 million fraud reportedly dealt a severe blow to its reputation.

Day and night, pressure has been mounting on the bank to assure clients that their savings and other interests in the bank are protected.

According to insiders, the early this year heist that saw a customer lose about $1.8 million (Shs 6.5 billion) after the financial institution’s system was compromised hit the bank hard.

.

And we are told that some customers have since been quietly withdrawing their money. As the bank tries to win back clients’ confidence, it has since fired ten staff to manage the exodus.

The bank’s head of people and culture, David K. Mutaka, said their investigations showed the fired staff were engaging in unethical behavior, negligence, gross misconduct, and dishonesty.

However, the internal memo announcing their firing and seen by this publication reads thus: “It is our individual responsibility to act in accordance with our group values and ethics. Our personal good conduct is a key value driver for our business, and we must actively work towards upholding and maintaining it. Through the Brilliant Basics initiatives in all teams, we have made good progress in awareness, upskilling, behavior, and recognition.

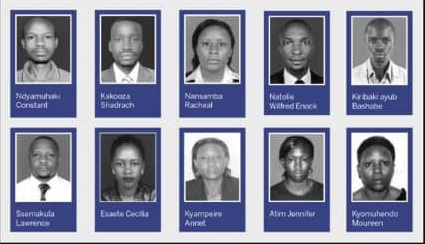

“Regrettably, we continue to see incidents of unethical conduct or gross negligence among us, and as earlier communicated, there will be zero tolerance for any behavior that compromises our values. In Q3 [January, February, and March] so far, following group investigations, a total of 10 employees exited due to unethical behavior or negligence. The staff below have exited the bank for gross misconduct and dishonesty.”

Mutaka goes on to name those fired, and they include Constant Ndyamuhaki, sales consultant Shadrac Kakooza, Namuriba Racheal, senior relationship manager Natolie Wilfred Enock, Kiribaki Ayub Bashabe, and teller Lawrence Ssemakula.

Others who have been knifed include electronic banking manager Jeniffer Atim and credit evaluation officer Moureen Kyomuhendo.

written by @enock katamba

- Mr. katamba Enock: Professional designer with experience in web designing who started this activity in 2019 at Kyambogo University after graduation . Contact me on : (+256-758287080)

Latest entries

International newsOctober 22, 2024Vladimir Putin Gathers Allies To Show West Pressure Isn’t Working

International newsOctober 22, 2024Vladimir Putin Gathers Allies To Show West Pressure Isn’t Working SportsOctober 19, 2024Manchester United Beat Brentford To Ease Pressure On Ten Hag

SportsOctober 19, 2024Manchester United Beat Brentford To Ease Pressure On Ten Hag NationalOctober 19, 2024Bushenyi RDC Suspended for falling in love with a S.3 student

NationalOctober 19, 2024Bushenyi RDC Suspended for falling in love with a S.3 student Celebrity GossipOctober 18, 2024Gravity Omutujju Mourns the death of his mother, Mrs. Jane Kajoina

Celebrity GossipOctober 18, 2024Gravity Omutujju Mourns the death of his mother, Mrs. Jane Kajoina